Customer Resilience

At Liberty Mutual, we understand that insurance plays a key role in building more resilient individuals, businesses and communities. Our products provide protection from the unexpected and are delivered with care, which has elevated importance in the face of increasing uncertainty.

"Helping to get our customers back on their feet at the time of a claim is a core part of what we do, and our work doesn't stop there. By enabling resilience for our policyholders, partners and communities through innovative products, coverages and tools, we help people embrace today and confidently pursue tomorrow.” - Hamid Mirza, President, USRM

Supporting our customers

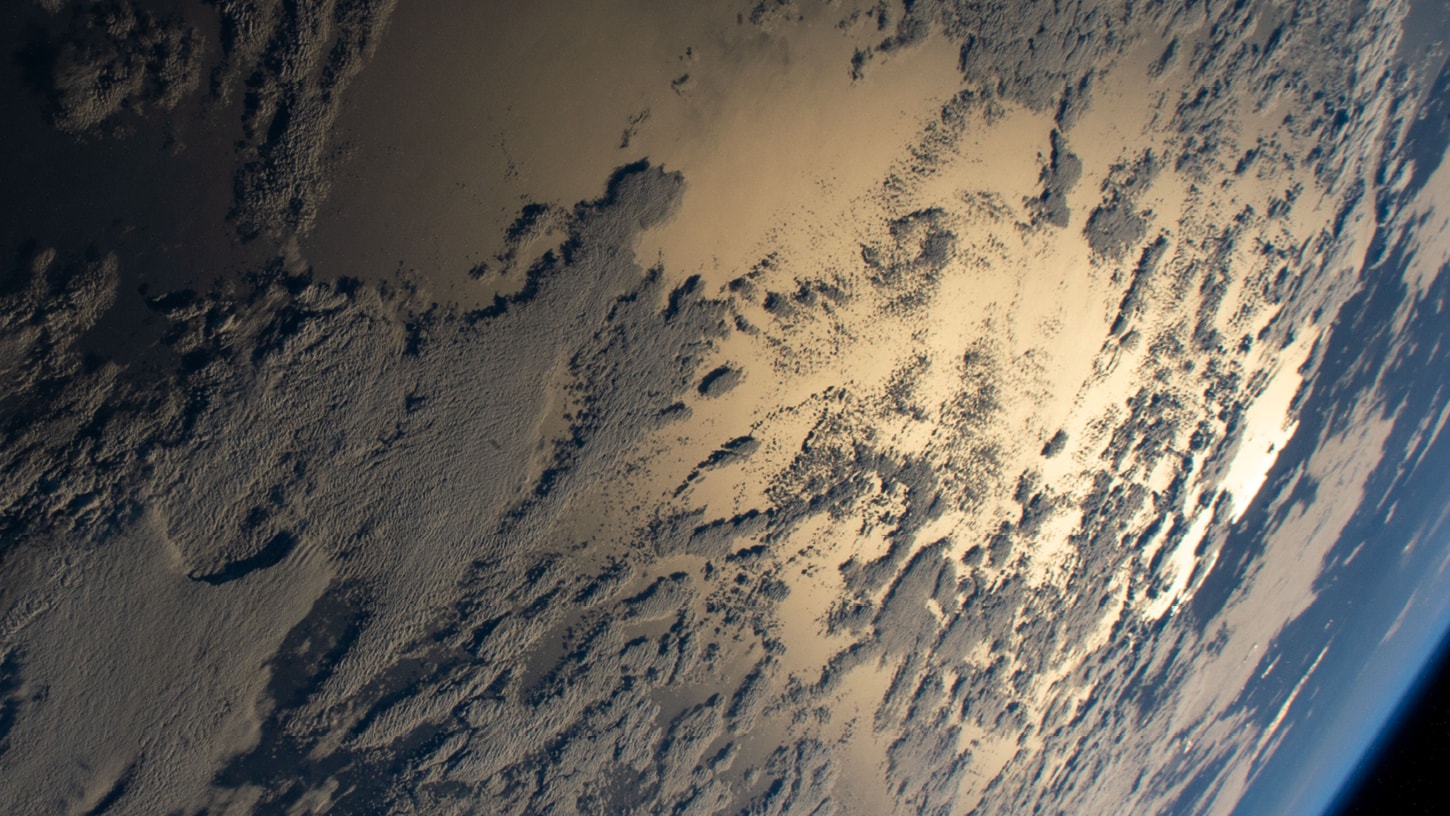

Catastrophes like hurricanes, wildfires, hail and floods are growing in both severity and frequency. With technology improving the accuracy of trigger modeling, we can provide coverage across both developed and emerging markets, particularly in areas vulnerable to severe weather-related events and disasters.

“You feel so overwhelmed that the idea of starting an insurance claim feels almost impossible… The sense of being lost in the woods was pretty quickly alleviated when our agent calmly and slowly showed me step by step that we’ll get through this process together… I felt compelled to share this because suffering from such a catastrophic event is hard to recover from, but the team at Liberty Mutual have made it possible.” – Liberty Mutual Policyholder

Partnerships

To ensure resilience for our customers and communities, we recognize that we cannot act alone. Liberty Mutual is collaborating with public and private partners to collectively focus on building a more resilient future together.

Webinar Replay: Building Today for a Resilient Tomorrow

Liberty Mutual, in partnership with Reuters, explore how federal, state and local elected officials can prepare their communities for the impacts of climate change through investing in and prioritizing resilient infrastructure.

Partner Spotlight: Increasing community resilience with IBHS

Collaborations between industry leaders and research institutions play a crucial role in how Liberty Mutual helps communities prepare for disasters. Liberty’s partners at the Insurance Institute for Business & Home Safety (IBHS) conduct research to improve building resilience against natural disasters by testing construction materials and methods. This research then informs standards that minimize damage and enhance safety, while also helping educate customers about how to make their homes safer.

Kristin Piltzecker, the head of the catastrophe management team within U.S. Retail Markets (USRM), is a former chair of the IBHS Advisory Council. She and her team leverage IBHS research to inform pricing, underwriting and exposure management for all natural perils. By leveraging IBHS’s research, not only are we able to offer customers a more accurate price, but we’ve also partnered with them to co-publish the Liberty+, Safeco+ and WeatherReady platforms, which help educate our policyholders on how to safeguard their homes.

“As we continue our work,” says Piltzecker, “there’s a shift from focusing solely on individual home resilience to building community resilience. Ensuring entire neighborhoods can withstand disasters is essential for protecting families, homes and communities when disaster strikes.”

As we look ahead, Liberty Mutual will continue to explore ways of incorporating IBHS’ research to protect our customers and their homes, including leveraging their great work on wildfire resilience.

Partners for Progress: Researching Climate Resiliency

Partners for Progress video featuring ERM and our partner IBHS discussing the importance of residential resiliency.

Featured Partners

Featured Articles

Event Spotlight: 2021 Climate & Resilience Risk Workshop

NOAA and Liberty Mutual partnered to host the virtual Climate and Resilience Risk Workshop this October that brought together key stakeholders from the government, climate, insurance and financial sectors to discuss the policy landscape and explore the challenges with respect to climate data and community impacts of climate change.