August 03, 2015 - New Liberty Mutual Insurance and SADD survey finds majority of teens engage in dangerous driving behaviors to accommodate “always on” lifestyle; reveals parents as unlikely culprits

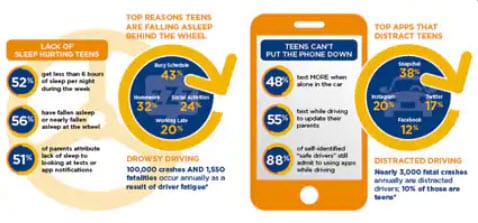

Many have heard the phrase coined among today’s teens, “Fear of Missing Out” (FoMO). While most perceive it as a harmless mantra for today’s hyper-connected youth, a new study released by Liberty Mutual Insurance and SADD (Students Against Destructive Decisions) reveals that the pressures of this “always-on” lifestyle have manifested in potentially deadly consequences behind the wheel. From maintaining full school and extracurricular schedules, to constant technology updates – it appears that teens are more hyper-connected and exhausted than ever. The new study finds that nearly half (48 percent) of teens report texting more when alone in the car – most often to update their parents. Just as concerning, 56 percent of teens have fallen asleep or nearly fallen asleep at the wheel – revealing the potential risky implications “FoMO” may have on today’s young drivers and signaling an important wake-up call needed for both parents and teens.

Teens Under Pressure to Stay Hyper-Connected

Nearly 3,000 fatal crashes in 2013 were caused by distracted drivers, and 10 percent of those deaths were teens (National Highway Traffic Safety Administration, NHTSA). From texting to apps and social media, today’s teens are faced with innumerable disruptions behind the wheel.

According to the survey, teens feel parents – more than anyone else – expect immediate replies to their text messages, even while driving. Fifty-five percent of teens report texting while driving in order to update their parents, and nearly one in five (19 percent) believe that their parents expect a text response within one minute, and 25 percent within five minutes – even while driving. However, the survey reveals a disconnect, as 58 percent of parents say they do not have set expectations on teens' response time - showing a need for more open conversations about driving among parents and teens.

Connecting with parents isn’t the only distraction for young drivers. The survey also uncovers one-third (37 percent) of teens report texting to confirm or coordinate event details – another sign of their strong desire to stay connected. Additionally, one in three (34 percent) of teens take their eyes off the road when app notifications come in while driving, and an alarming number (88 percent) of teens who consider themselves “safe” drivers report using phone apps on the road.

Most popular apps teens report using behind the wheel include:

- Snapchat: 38 percent

- Instagram: 20 percent

- Twitter: 17 percent

- Facebook: 12 percent

- YouTube: 12 percent

“Today’s hyper-connected teens’ ‘fear of missing out’ can put young drivers at risk on the road as they may be more plugged into their devices than the actual driving task,” said Dr. William Horrey, Ph.D., principal research scientist at the Liberty Mutual Research Institute for Safety. “Teens may be at higher risk because they don’t always have the attentional capacity to deal with all the complexities on the road. These distractions in addition to fatigue may be even more significant with teens due to their relative driving inexperience as well. It’s so important for parents and teens to recognize and talk about these dangerous distractions to ensure better safety behind the wheel.”

Dangers Beyond Digital: “Always On” Lifestyle can Lead to Drowsy Driving

Technology behind the wheel isn’t the only peril stemming from teens’ “FoMO.” Teens’ reluctance to “miss out” and an “always-on” lifestyle are creating drowsy young drivers – and the new data shows parents are largely unaware of this danger: While 61 percent of parents believe their teens get enough sleep, 52 percent of teens get less than six hours of sleep each night during the week. Even more, nearly three quarters (70 percent) of teens admit to driving while tired – making them less attentive and delaying reaction times. Among the parents who think their teens don’t rest enough, 51 percent attribute it to them staying up to read text messages and notifications – revealing signs of “FoMO” infringing on sleep. With an estimated 100,000 crashes and 1,550 fatalities annually directly resulting from driver fatigue (NHTSA) – it’s critical that parents and teens alike receive a wake-up call on this dangerous threat.

“Today’s parents are juggling their own busy schedules, and too often young drivers’ risky habits go unrecognized,” said Stephen Gray Wallace, senior advisor for policy, research and education at SADD. “It’s critical that parents focus on pinpointing these dangerous driving habits early on – from drowsy driving to technology use behind the wheel – and have frequent conversations with their children about what safe driving really means.”

Many don’t realize the effects of drowsy driving are similar to driving under the influence. After simply 18 hours awake, cognitive impairment equates to blood alcohol content (BAC) of .05 percent, and after 24 hours awake up to a BAC of .10 percent – higher than the legal limit in all states (according to the Centers for Disease Control and Prevention).

The study revealed that more than half of teens reported falling asleep or nearly falling asleep at the wheel – with the leading culprits being:

- Busy schedule (extracurricular, school, etc.): 43 percent

- Staying up late completing homework: 32 percent

- Staying up late for social activities: 24 percent

- Working late hours during the week: 20 percent

- Being tired or hung over from drinking/partying the night before: 10 percent.

Help to Keep Teens Safe

Parents and teens must recognize the dangerous implications of today’s hyper-connected and overscheduled teens and implement ways to reduce these risks on the road. It’s essential for parents and teens alike to have open and honest conversations and set expectations around responsible driving, and Liberty Mutual Insurance and SADD encourage parents and teens to consider signing a Parent-Teen Driving Contract. The Contract is both a conversation-starter about safety issues and a customized agreement that provides both parents and teens an easy roadmap to uphold family driving rules empowering open communication helping to lead to safer behavior behind the wheel. Whether teens are planning to get a permit or already on the road, this guide demonstrates a commitment to safe and responsible driving, and the signed agreement can help earn mutual trust to give better peace of mind. To download a contract, visit www.LibertyMutual.com/TeenDriving.

About the Study

Liberty Mutual Insurance and SADD commissioned ORC International to conduct a qualitative and quantitative methodology to measure teen driving attitudes and behaviors. The study was initiated with a series of focus groups held in Chicago and Washington, D.C. from October 28-29, 2014, followed by a survey among 1,622 eleventh and twelfth graders from across the country. Overall the findings from the study can be interpreted at a 95 percent confidence interval with an error margin of +/- 2.23 percent. Error margins for subsets such as licensed drivers will be wider. Additionally, the study surveyed 1,000 parents of high school aged teenage drivers, providing an overall error margin of +/- 2.94 percent.

About SADD

SADD, the nation’s leading peer-to-peer youth education, prevention, and activism organization, is committed to empowering young people to lead initiatives in their schools and communities. Founded in 1981, SADD today has thousands of chapters in middle schools, high schools and colleges. SADD highlights prevention of many destructive behaviors and attitudes that are harmful to young people, including underage drinking, other drug use, risky and impaired driving, and teen violence and suicide. To become a Friend of SADD or for more information, visit sadd.org, parentteenmatters.org or follow SADD on Facebook, Twitter and YouTube.

About Liberty Mutual Insurance

Liberty Mutual Insurance helps people preserve and protect what they earn, build, own and cherish. Keeping this promise means we are there when our policyholders throughout the world need us most.

In business since 1912, and headquartered in Boston, Mass., today Liberty Mutual is a diversified insurer with operations in 30 countries and economies around the world. The company is the third largest property and casualty insurer in the U.S. based on 2013 direct premium written as reported by the National Association of Insurance Commissioners. Liberty Mutual also is ranked 78th on the Fortune 100 list of largest corporations in the U.S. based on 2014 revenue. The company employs over 50,000 people in more than 900 offices throughout the world.

The fifth-largest auto and home insurer in the U.S., Liberty Mutual (libertymutual.com) sells full lines of coverage for automobile, homeowners, valuable possessions, personal liability, and individual life insurance. The company is an industry leader in affinity partnerships, offering car and home insurance to employees and members of more than 14,000 companies, credit unions, professional associations and alumni groups.

Media Contact:

Glenn Greenberg

Liberty Mutual Insurance

617-574-5874

Glenn.Greenberg@LibertyMutual.com